Naples Real Estate Market Watch May 2018

Naples Real Estate Market Watch May 2018

Real Estate Market Watch March 2018 – Naples, Bonita Springs, and Estero

Tidbit

Summer activity off to a great start!

Downing-Frye new pending sale contracts up 12%

year-over-year for the 1st 20 days of June

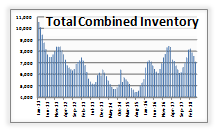

COMBINED INVENTORY – Naples, Bonita/Estero

Retreating, still… – The combined inventory for Naples, Bonita Springs, and Estero is continuing the seasonal retreat. Steady sales in May combined with fewer new listings coming to the market both lead to the overall reduction in available for sale inventory. The combined inventory is now ~7,000 listings, the lowest point, again, in 2018. Inventory dropped about 7%.

Retreating, still… – The combined inventory for Naples, Bonita Springs, and Estero is continuing the seasonal retreat. Steady sales in May combined with fewer new listings coming to the market both lead to the overall reduction in available for sale inventory. The combined inventory is now ~7,000 listings, the lowest point, again, in 2018. Inventory dropped about 7%.

Both Naples and Bonita-Estero markets saw an inventory reduction of 6% and 9% respectively month-over-month.

The combined markets’ absorption rate index continues to drive toward better numbers. Given the six month rolling average of sales per month, there is now just over 6 months of inventory on the market compared to just over 7 months noted last month. This is nearly a balanced market which we see usually every summer in May or June compared to the over saturated inventory situation during the Fall, Winter, and Spring season.

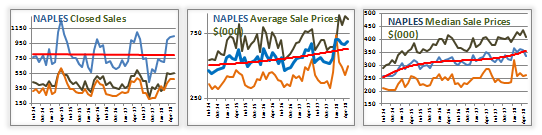

CLOSED SALES – Naples, Bonita/Estero

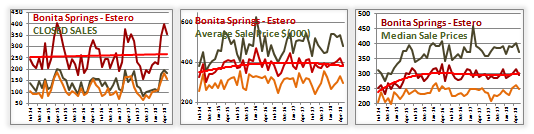

Sales volume pulls back… –The overall sales volume for the Naples and Bonita-Estero markets pulled back about 2% month-over-month and 4% year-over-year. Naples market was up 2% while the Bonita-Estero market was down 12% compared to the previous month.

NAPLES REAL ESTATE

AVERAGE PRICE PAID

Up, a bit… – Naples overall average price paid was up year-over-year 2%. The month-over-month number was up 3%, a modest increase overall. The condominium market and the single-family home market seem to be bouncing up and down on a month to month basis.

The overall average price paid for all property types was $685,000 compared to $663,000 in the prior month. The average price paid for a single-family home was $858,000 compared to $882,000 in the prior month and $499,000 for a condominium compared to $433,000 in the prior month.

In 2017 the average overall monthly closed sale price was $568,000 and now 2018 through May the average sale price is $685,000. So far, 2018 is looking pretty good!

MEDIAN SALE PRICE

(The number where 50% of the homes sell above and below.)

Dropped…– The overall median price was down 3% year-over-year and down 7% month-over-month. Single-family homes dropped while condominiums bumped up just a bit.

The overall median price paid for all property types was $335,000 compared to $360,000 the previous month. The median price paid for a single-family home was $410,000 from $435,000 the previous month, and the median price for a condominium was $262,000 from $259,000.

BONITA SPRINGS REAL ESTATE and ESTERO REAL ESTATE

AVERAGE PRICE PAID

Dropped… – The overall average price paid for a property in the Bonita/Estero market decreased 8% month-over-month and decreased 7% year-over-year. Both single-family homes and condominiums suffered.

The overall average price paid for a property was $386,000 from $422,000 the previous month. The average price paid for a single-family home was $481,000 compared to $539,000 and $296,000 for a condominium from $331,000.

The median price paid is a much better indicator than average price as it tells buyer’s appetite for spending. One large or small sale can skew the average where the median indicates the midpoint of buying activity.

MEDIAN SALE PRICE

(The number where 50% of the homes sell above and below.)

Dropped… – The overall median price paid for a property in the Bonita/Estero market dropped month-over-month but was steady year-over-year. The year-over-year number was flat and on a month-over-month basis it was down 6% giving back the 6% increase posted the previous month.

The overall median price paid for a property was $296,000 compared to $315,000. The median price paid for a single-family home was at $370,000 compared to $400,000 and for a condominium $248,000 compared to $260,000.

The median price paid is a much better indicator than average price as it tells buyer’s appetite for spending. One large or small sale can skew the average where the median indicates the midpoint of buying activity.